Discover 17 important couple money goals on the path to financial success. Learn how to unlock wealth and build a prosperous future together.

- Couples and finances

- What financial goals should couples have?

- How do you set financial goals in a couple?

- How do most couples handle money?

- Financial rules for couples

- Couple money goals examples

- Couple money goal #1: Create a budget and stick to it

- Couple money goal #2: Pay off debt

- Couple money goal #3: Build an emergency fund

- Couple money goal #4: Have no secrets about money

- Couple money goal #5: Respect each other’s financial decisions

- Couple money goal #6: Check in before making big purchases

- Couple money goal #7: Have open communication about money

- Couple money goal #8: Pay off the mortgage

- Couple money goal #9: Be smart with money

- Couple money goal #10: Live below your means

- Couple money goal #11: Understand your financial health

- Couple money goal #12: Combine your accounts

- Couple money goal #13: Understand who has greater financial confidence

- Couple money goal #14: Make it a habit to talk about money

- Couple money goal #15: Get rid of unnecessary credit cards

- Couple money goal #16: Make saving a habit

- Couple money goal #17: Increase your credit scores

- Financial goals for married couples

- Long-term goals for married couples

- Retirement savings goals for couples

- Final thoughts on couple money goals

- Pin for later!

Couples and finances

Finances can be a big source of conflict for couples. But they can also bring you closer together.

One way to make finances an asset in your relationship is to have couple money goals.

What financial goals should couples have?

Couples should have financial goals that make sense for their unique situation. They should be attainable but also make the couple strive to work together to reach their goals.

Does it make sense for a low income couple to make a goal to save a million dollars? This goal is probably not attainable for a low income couple and does not fit their unique situation.

Instead, couples should look at their financial health (their income, expenses, and dreams). What needs to change? What do they need to continue doing?

Starting with your financial health will help you form a picture of what your current situation is. It’ll help you form attainable goals that you will want to and be able to achieve.

How do you set financial goals in a couple?

Setting financial goals as a couple doesn’t need to be difficult.

Couples should set financial goals together, with both immediate and long-term goals in mind. What goals are important to you know? Prioritize the most crucial and immediate goals so you can focus on them first.

Where do you see your family in 5 years? What does it look like? Does your current financial situation support your vision?

What financial situation would you like your family to be in in the next 10, 15, or 20 years? It’s important to explore these visions when forming your couple money goals. They will help you stay focused on the right goals for you and your partner.

Couples should focus on each other’s needs and consider their combined needs. It’s ok to have individual money goals as well as combined goals.

Follow this step by step process to set financial goals in a couple:

- Have a conversation about your wants, needs, and goals for your future together

- Write down your goals and prioritize them

- Understand which goals are short term and which ones will take more time to achieve

- Make sure your goals are specific enough to know what you are striving for. Don’t just say you’ll “save more money”. That’s not very specific.

- Make sure your goals are attainable

How do most couples handle money?

A lot of couples have trouble handling money together. I suspect a lot of couples don’t pause to take a look at their financial situation and consider changing their approach.

Some couples have separate accounts and handle money individually. Others spend money based on their respective income.

Every couple is different. Handle money in the way that makes the most sense to you and your partner.

Financial rules for couples

Financial rules are important for couples because they help set expectations. As couples grow together, their money will (hopefully!) grow too.

How will you spend/save that money? What is important to the two of you? Set rules now so that you can set yourselves up for success later.

Here are some great financial rules for couples (I’ll go into more detail on these below in the next section):

- No secrets when it comes to money

- Combine your accounts

- Be smart about your money by planning ahead for big events (big trips, having a baby, etc)

Couple money goals examples

These couple money goals examples will help you get started on your own. Use this list to inspire your goals but don’t feel pressured to take on too many.

Remember to make your goals attainable.

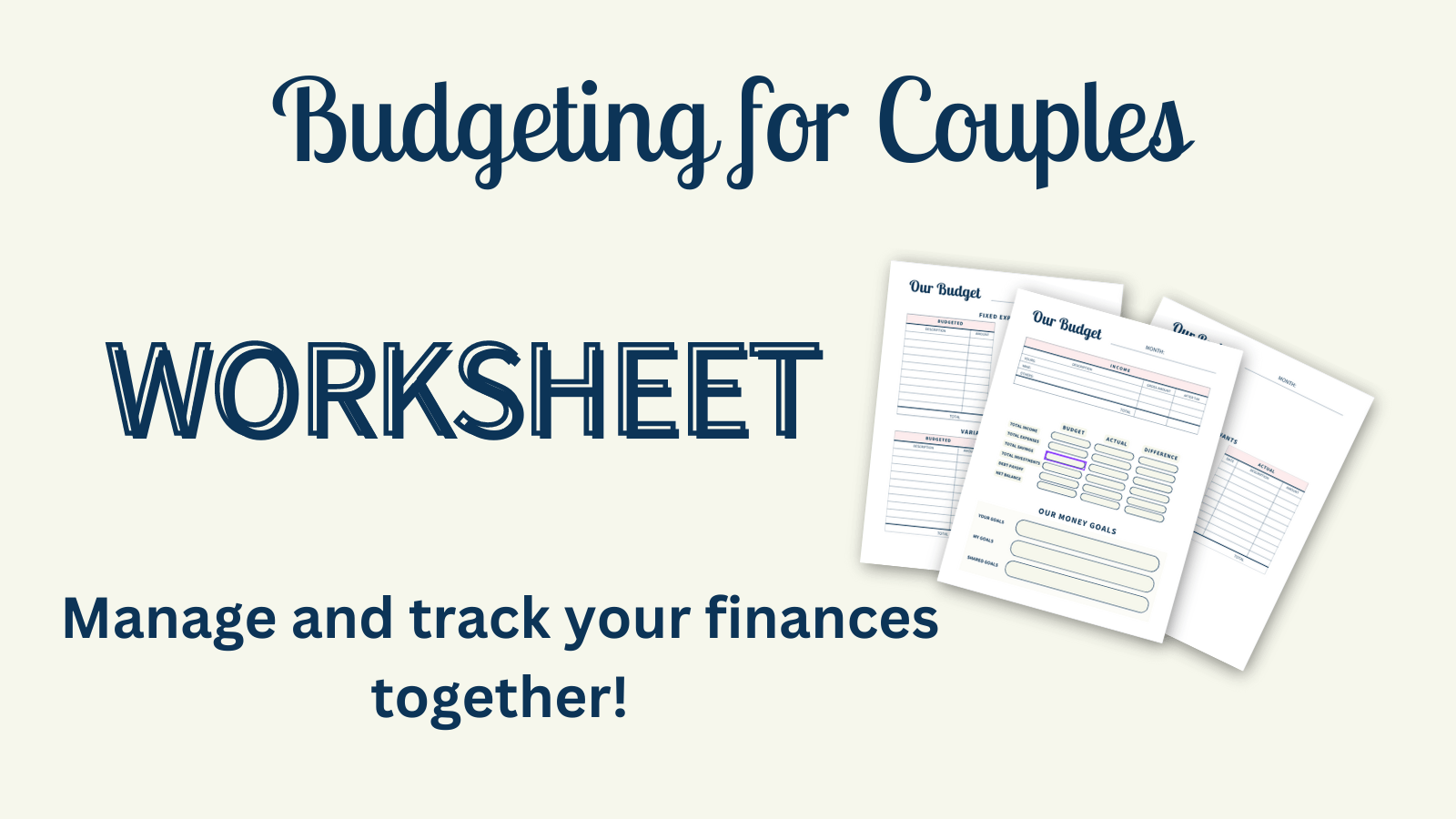

Couple money goal #1: Create a budget and stick to it

How much money are you both bringing in? How much are you spending? Is there any unnecessary spending that you can cut back on?

If you don’t have a budget, you might struggle to answer these questions. Budgeting is so important for your financial health. And it’s even more important for couples.

If you need help creating a budget, this post has great advice for couples!

Couple money goal #2: Pay off debt

Do you have student loans? What about credit card debt?

I paid off debt by first consolidating it into a low interest personal loan. That helped me pay off more of the principal on the loan. It went away a lot faster with this plan.

Come up with your own plan. What makes sense for you and your partner?

Couple money goal #3: Build an emergency fund

If both you and your partner were to lose your jobs, would you be ok for a couple of months? It’s important to have an emergency fund for situations like this.

Emergency funds are important for couples because so much can happen. Your house could need a major repair. Your car could break down. You could end up with a large hospital bill.

Instead of worrying about all of the “what ifs”, have an emergency fund to help you take care of the financial side of any future emergencies.

Couple money goal #4: Have no secrets about money

You might already share bank accounts and have no secrets about money. But if you do keep things from your partner, you might want to consider making it a goal to change this.

How will you be able to truly plan for your future together if you keep secrets about money?

Couple money goal #5: Respect each other’s financial decisions

Your couple money goals won’t get very far if you don’t respect each other with finances.

If you don’t respect each other’s financial decisions, you need to figure out why. Has your partner made bad financial decisions in the past?

What can you both do to earn each other’s respect when it comes to finances? Make changes so you can get to a respectful place in your relationship.

Couple money goal #6: Check in before making big purchases

This is an important marriage boundary to have. Have a set number that you both agree on. When one of you wants to make a purchase above that number, check in first.

It’s as simple as that. We use this goal a lot. And it can be a quick conversation.

Checking in with your partner before you make a big purchase makes them feel valued when it comes to your combined money.

Couple money goal #7: Have open communication about money

You won’t get very far if you don’t talk about money. You need to be honest about your spending habits with each other.

You also need to be honest about your long term goals. If you’d like to own an RV one day, you need to talk to your partner about it.

What money conversations do you and your partner need to start having? Make that a goal!

Couple money goal #8: Pay off the mortgage

You might want to consider contributing extra money to your monthly mortgage payment. It will save you money on interest in the long run.

Here are some great benefits to paying your mortgage early.

Couple money goal #9: Be smart with money

Do you spend money wisely? Do you have investment accounts? Do you know basic financial terms?

It might be time to increase your knowledge about finances so you can make better choices with your money.

Couple money goal #10: Live below your means

Do you make more money than you spend? Or is it the other way around?

Living below your means helps you save for retirement, start an emergency fund, and enjoy some extra occasional expenses along the way.

When Josh and I first got married, we lived off of his salary alone. I was making good money but we decided to focus my income on paying off my student loans. This made things easier when we had our first baby and I became a stay at home mom.

We were already used to living off of one income. There weren’t many adjustments that needed to be made when we became a one income family.

Couple money goal #11: Understand your financial health

Are you on track for retirement? (There’s more on retirement in the section below.) Are your investment accounts making money? Do you spend too much on Starbucks coffee?

Understanding your financial health is an important couple money goal. If you don’t know where to start improving, this is a great one to begin with!

Couple money goal #12: Combine your accounts

A recent study found that couples who combine their finances are actually happier.

Do you and your partner have separate accounts? You might want to consider the benefits of combining your accounts. It’ll certainly be easier to budget.

Couple money goal #13: Understand who has greater financial confidence

In a study by Jenny Olson and Scott Rick, it turns out:

“Couples benefit from a shared understanding of which partner has greater financial confidence and placing greater weight on that partner’s preferences.”

Jenny Olson and Scott Rick

But what does this mean? It means you need to lean on each other’s strengths. If one of you has a better understanding of budgeting and finances, use it! Work together by utilizing each other’s strengths.

Maybe one of you is better at finding coupons for your expenses. Use that skill! Help each other out by doing what you feel the most comfortable with and relying on your partner to help with the things you’re not comfortable with.

Couple money goal #14: Make it a habit to talk about money

Talking about money with your partner or spouse has so many benefits. It can help predict how financially healthy your accounts will become.

If you find it difficult to talk about money, you’ll want to first discover why. Are you ashamed of certain purchases? Are you completely honest about your debt?

You might need to work on your emotional intimacy first if you can’t be honest about your spending habits. Here are some ways to help you build emotional intimacy.

Couple money goal #15: Get rid of unnecessary credit cards

Credit cards can actually be good for your credit score. (There’s more about credit scores in #17 below.) But only if you don’t max them out and make regular payments.

You do need to be careful, though. Having too many credit cards can hurt your credit score. It also makes it harder to track where your money is going if it’s spread out over several cards.

Sit down with your wallets and “lay all of your cards out on the table”. If you have some that you don’t really use, consider closing those accounts.

Couple money goal #16: Make saving a habit

Did you know your bank can automatically pull money from your paycheck and put it into a savings account? You don’t have to do anything.

This is a great tip because it’s easy to “forget” about that extra money. It becomes a normal habit when it’s just happening on its own in the background.

Couple money goal #17: Increase your credit scores

A good credit score can help you get a better rate on a mortgage or auto loan. This will save you money in the long run.

When was the last time you checked your credit score? Sit down together and make it a priority to increase both of your credit scores.

There are a lot of ways to improve your credit score. Do what makes the most sense for you and your partner.

Financial goals for married couples

Couples nowadays treat their finances as if they’re married. That’s why all of the couple money goals above can apply to married couples.

If you have kids, I would add one extra goal: to teach your children about money. This is a slow process that can start when they are young. But get on the same page now before you begin teaching these lessons.

Long-term goals for married couples

It’s important to note that some of the goals above are more long-term. It’s good to have a combination of short and long term goals.

Before you finalize your couple money goals, make sure you don’t have too many of either short or long term goals.

Retirement savings goals for couples

Planning for retirement is an important couple money goal that deserves a section all to itself. How are you planning for retirement? Here are some retirement savings goals for couples:

Start a retirement savings account

If you don’t have any savings yet, you’ll need to start here. Talk to your partner about what options you both have. Do your employers offer a 401k? Will they match any contributions?

There are a lot of different types of accounts to choose from. Here is a list from the IRS to help get you get started.

Increase your contributions to your retirement savings account every few years

As you get older, your pay might increase. You’ll get promotions. You’ll move to a higher paying job.

Consider increasing your contribution as your income increases. Your goal could be to increase your contribution every 5 years or with every pay increase over a certain percent.

Have an end goal in mind for your retirement

How much money do you need to retire? I like to use this retirement calculator by NerdWallet.

It’s important to know how much you’ll need so that you can have an ultimate goal you’ll want to reach.

Final thoughts on couple money goals

Every couple should have a mixture of short and long term money goals. It’s important to make these goals together.

I want to reiterate again that you do not have to take on every goal in this post. I wanted to provide you with ideas to help you make better financial decisions together.

What couple money goals do you and your partner have? I’d love to hear from you in the comments below!

Pin for later!

I really enjoyed reading this post, thank you! Fantastic job!

I’m so glad you enjoyed it! I really appreciate the feedback. I had a lot of fun writing it and it gave me a few goals to add to my list as well 🙂